Digital pension and third pillar planning finally made accessible. DiVo, the 3a planning module, is a powerful solution your target group will love. We developed the DiVo pension planning module in collaboration with cantonal banks Luzerner Kantonalbank and St. Galler Kantonalbank. DiVo is flexible – we will show you how easy integrating it into your existing online banking solution is. Customer-friendly, efficient, secure – the smart choice for banks, insurance providers and fintech firms.

How you benefit from the retirement planning module from Ergon

-

Digital pension planning with proven customer satisfaction

-

Flexible, future-focused architecture

-

Individually expandable

-

White label solution with an adaptable design

-

Easy to integrate

-

Available either as an on-prem or a Software as a Service solution

-

Short lead time

What our digital pension platform for mobile devices can do

Developed mobile-first

As your clients are always on the move, we developed this retirement solution for mobile devices from the ground up.

Improved self-service

Open, deposit or invest: your clients can manage their money themselves with just a few taps.

Intuitive and informative

To wow your clients, our UX designers have adapted the 3a planning solution to meet user needs, right down to the smallest detail.

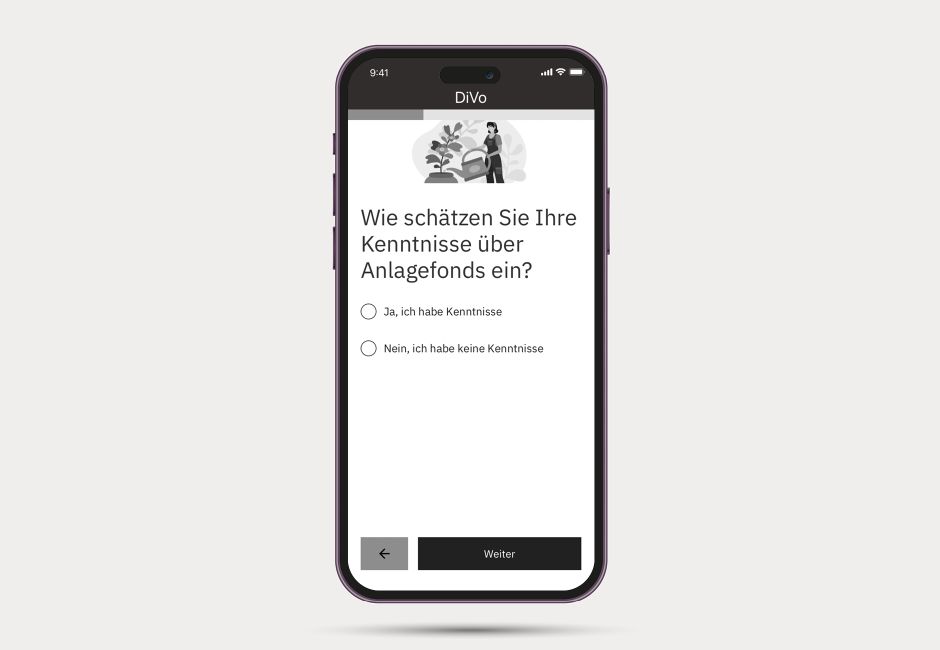

Targeted support

A brief questionnaire helps users to choose the products that are right for them.

A clear overview on the dashboard

The dashboard clearly and concisely shows how all of the portfolios are performing at a glance.

Customisable

Your clients can open, name and arrange multiple portfolios themselves.

Digital pension planning with DiVo. Customer-friendly, efficient, secure.

Functional scope of DiVo

Functional scope of DiVo

Risk profiling and determining an investment strategy

Risk profiling and determining an investment strategy

Product selection and acquisition

Product selection and acquisition

Dashboard with performance, product information, fund change or sale and much more

Dashboard with performance, product information, fund change or sale and much more

Transparent licence models and customer-centric services

You receive optimum support, from development through to operation of DiVo. This is provided by experienced teams made up of highly qualified experts from all the relevant areas – from business analysis, consulting and UX, to software engineering and testing. Implementation usually takes between 10 and 20 months. We place our trust in agile principles and transparent communication. The licensing policy is transparent. You pay a one-off fee and are given access to the module and basic functions. We can adjust DiVo to suit your needs on request. For any adjustments, we bill you for the costs and work involved. You can even get top-class support from Ergon at any time for an annual maintenance fee. This makes integration into your system landscape easier and ensures long-term, successful use.

“With fluks 3a, Luzerner Kantonalbank offers a simple and fully digital solution for investments in the 3rd pillar. With Ergon, we have a reliable partner who actively supports us.”

We look forward to hearing from you

We are pleased that you are interested in our services. Do you have any questions or a specific project idea? Tell us about it – with no commitment on your part. Our experts will contact you as soon as possible.